Put option formula

1978 The Value of an Option to Exchange One Asset for Another Journal of Finance 331. Con riferimento al problema di determinare il prezzo di unopzione put il procedimento è del tutto analogo nel caso.

Discounted Dividend Model Ddm Dividend Financial Management Model Theory

130 Options Contract Definition.

. In this episode of Accounting Basic. As you can see from the examples above a long put option trades total profit or loss depends on two things. The calculation of the PL and intrinsic value does matter and there is a different formula to do the same.

If youre working with small set of data on a one-off basis. Now we have created simple payoff calculators for call and put options. Both options are currently trading at 2 per share or 200 for one option contract representing 100 shares of the underlying stock.

Profit value at expiry - option cost number of contracts 100 _____ stock price - strike - option cost _____ number of contracts 100. Ten purchased one of the 50 dresses. Since the outbreak of COVID-19 there have been significant shortages of infant formulas nationwide.

As I understand in option put selling we do not pay the premium however we receive the premium. Its value in case of an up p or down movement p- in the underlying price S is maxX-uS0 and maxX-dS0 respectively. Call and Put Option Price Formulas.

Putcall parity is a static replication and thus requires minimal assumptions namely the existence of a forward contractIn the absence of traded forward contracts the forward contract can be replaced indeed itself replicated by the ability to buy the underlying asset and finance this by borrowing for fixed term eg borrowing bonds or conversely to. 80 -08 bps 808 bps. But this is not the case with the securities with.

This value can approximate the theoretical value produced by BlackScholes. The result with the inputs shown above 45 235 41 should be 165. In the option put selling you have given formula P L Premium Paid-Max0strike price-spot price.

Where cells G4 G5 G6 are strike price initial price and underlying price respectively. The lower underlying. Typically these options give their holders the right to purchase or sell an underlying debt.

As in the BlackScholes model a simple formula can be used to find the option price at each node in the tree. The formulas for d 1 and d 2 are. Current shortages have been largely caused by supply chain issues and the recent recall of several baby formula products over contamination concerns.

The Profit at expiry is the value less the premium initially paid for the option. The Put Option seller will experience a profit to the extent of premium received as and when the spot price trades above the strike price. Here are some tips on finding baby formula during the shortage and what you may safely consider if you absolutely.

If your data doesnt update frequently. However because stock prices cant fall below 0 the maximum loss you face can be determined by the following formula. Read about its intrinsic value PL payoff etc.

Price Put Xe-rt 1-Nd 2 P 0 1-Nd 1 Where d 1 and d 2 can be calculated in the same way as in the pricing of call option explained above. Through the tracking link the boutique can see that theyve gotten 50 visits. Read more can be easily measured by discounting the cash flows using the benchmark yield curve.

Pricing a European Put Option Formula. The value of a call option for a non-dividend-paying underlying stock in terms of the BlackScholes. The general formula for calculating the borders is strike price plus or minus the sum of the two option premiums in our example 35 2 2 31 and 35 2 2 39.

What you have paid for the option in the beginning. A put options time value which is an extra premium that an investor will pay above the options intrinsic value can also affect the options value. Important Points about Option Adjusted Spread.

The put option profit or loss formula in cell G8 is. The BlackScholes formula calculates the price of European put and call optionsThis price is consistent with the BlackScholes equation. To put this more clearly let me assume two situations on the Bank Nifty Trade.

Eligible brands include Wholehearted Good Lovin You Me So Phresh Well Good Reddy Harmony Bond Co Good2Go. Well yes but adding data into a spreadsheet by hand shouldnt be dismissed entirely. Value stock price - strike.

The discount applies to your online purchase subtotal for the pickup in-store products only. When you sell a put option you are giving the option holder the right to sell you shares at the strike price. The value of a put option using single-period binomial model can be calculated.

Call option C and put option P prices are calculated using the following formulas. They use this formula to calculate their ROI. Practical Example of European Option.

The first component is equal to the difference between strike price and underlying price. Read breaking news for Waynesboro VA weather traffic crime sports entertainment politics and more. A benchmark index for the performance of a cash-secured short put option position is the CBOE SP 500 PutWrite Index ticker PUT.

Stock XYZ is trading for 60. On the other hand put option sellers face limited risk. La formula di Black e Scholes è lespressione per il prezzo di non arbitraggio di unopzione call.

Please contact your local Petco for availability. 10 x 033 x 50 - 300 300 x 100 -45. An call options Value at expiry is the amount the underlying stock price exceeds the strike price.

What you can get when exercising the option. A derivative financial instrument in which the underlying asset is a debt security. This follows since the formula can be obtained by solving the equation for the corresponding terminal and boundary conditions.

She also directs viewers to the bio in the videos caption. However there are still some things we. Selling a 35 strike put option.

A call option is an agreement that gives an investor the right but not the obligation to buy a stock bond commodity or other instrument at a specified price within a specific time. Volatility is 10 and the risk-free rate is 5. A put option put is a contract that gives the owner the option but not the requirement to sell a specific underlying security at a predetermined price strike price within a certain.

Put Option Payoff Formula. The strike price is 60. If the Ill Pick It Up option is not available it is not available in stores.

Dividend yield was only added by Merton in Theory of Rational Option Pricing 1973. Subscribe for more Accounting Tutorials httpsgeniussubtothechannelEverything you need to know about the Invoice. Maximum loss for put option seller Strike price.

Of those visits 30 people put an item in their cart. Where Nx is the standard normal cumulative distribution function. Although it might seem inefficient there are scenarios where this is the best or only option for getting data into a spreadsheet.

A put option contract gives the option buyer the right to sell a contract at a particular price. The payoff pattern of a put option an option that entitles the holder to sell the underlying at the exercise price is exactly opposite ie. The price of option-free bonds Bonds Bonds refer to the debt instruments issued by governments or corporations to acquire investors funds for a certain period.

Interesting Yum Put And Call Options For February 26th Call Option Options February

Interesting Nvda Put And Call Options For December 24th Call Option Options December

Selina Concise Mathematics Class 9 Icse Solutions Compound Interest Using Formula A Plus Topper Student Problem Solving Physics Books Mathematics

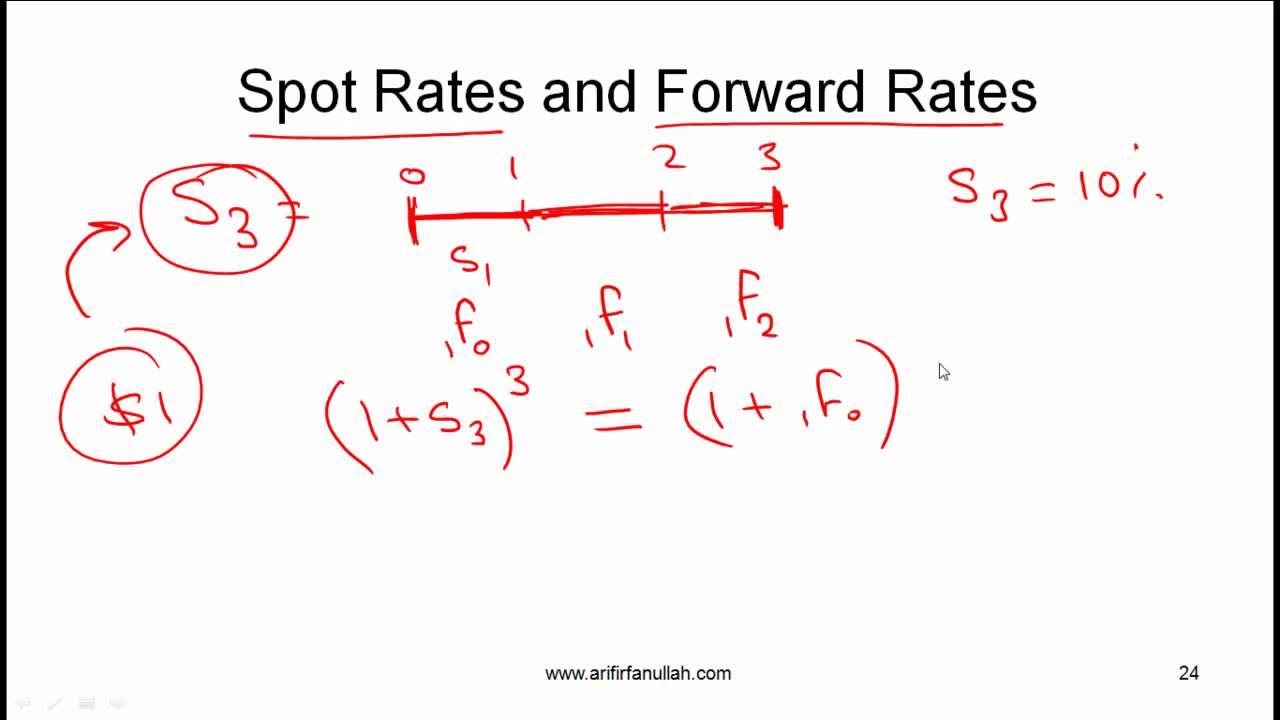

Cfa Level I Yield Measures Spot And Forward Rates Video Lecture By Mr Arif Irfanullah Part 5 Youtube Lecture Mr Video

Put And Call Options Simply Explained By Bill Bill Poulos Of Profits Run Offers Simple Explanations So That Ever Call Option Option Trading Financial Education

Interesting Siri Put And Call Options For August 28th Call Option Options August 28

Options Trading Terminology Are Explained In Hindi We Will Also See Option Chain With Call And Put Option On Nse Website To Option Trading Put Option Trading

Must Know Cfa Formulas Business Insider Fisher College Of Business Business Insider Formula

Options Pricing Option Pricing Pricing Formula Call Option

Find Your Perfect Anti Aging Routine Anti Aging Skin Products Anti Aging Skin Treatment Aging Skin Care

Options Are Financial Derivatives Mainly Of Two Types Call Option And Put Option We Must Understand These Concepts Fo Put Option Call Option Option Trading

Put Call Parity Refers To The Static Price Relationship Between The Prices Of Put And Call Options Of An Asset With Th Exam Fisher College Of Business Formula

First Week Of November 20th Options Trading For Tata Motors Ttm Option Trading Trading Call Option

Call Put Parity Explained For Begineers Youtube Risk Management Option Trader Option Strategies

Among The Best Chart Patterns I Ve Discovered For Straddle Option Trade Opportunities Are What Are Commonly Known Option Trading Option Strategies Strategies

Selina Concise Mathematics Class 9 Icse Solutions Compound Interest Without Using Formula A Plus Topper Hydrogen C Mathematics Compound Interest Solutions

Interesting Bhi Put And Call Options For May 6th Call Option Option Trading Option Strategies